The Pitfalls of Selling a Cash Business

Business For Sale Business Information For Sellers Sell Sell a Business Selling a business Valuation ValuingPosted by Patrick McAdams on

Business Brokers talk to many business owners each week about selling their businesses. As a broker, I have to determine if the business they own is sellable. Business owners will ask me “What do you mean, is my business sellable?” In their minds, of course someone will want to buy it. They think “I make money, I have a beautiful home, a boat, a convertible, and a country club membership! It’s a money maker!” As a broker I must temper their enthusiasm and ask all the right questions to determine if it is sellable.

The most common reason I find that a business is not sellable is that there is not enough cash flow or Sellers Discretionary Earnings (or SDE) to support the sale. What I mean by that is that the cash flow the business generates right now, plus the owner’s salary, interest, depreciation, amortization, and whatever perks they take out of the business is not enough to support the debt payment of the business, plus pay the owner a reasonable salary to start, and still have net profit in the business.

Some small businesses can be bought for mostly cash, but many businesses need to be financed in some way. Whether it is a loan against the buyer’s home, a loan from a relative, or an SBA Loan, the buyer will most likely need help financing a portion of the business.

“There’s more money in the business than my books show.”

As a broker, that’s a red flag to me.

There are many business’ where the owner says to a broker “There’s more money in the business than my books show.” As a broker, that’s a red flag to me. There is no way to prove that the business makes all the cash that the owner claims. As a broker, I can’t value or sell a business based on unreported income in the business. If the seller can’t prove it to a buyer or the bank how much the business cash flows because it isn’t “on the books,” I can’t do much to help them.

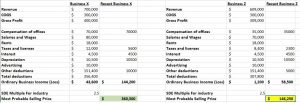

I have two sample income statements for two identical fictional businesses. Business X reports all revenue and pays its owner a fair salary. Business Z does the exact same amount of revenue but only reports part of it and takes the rest in cash and pays some of its employees in cash. Owner Z does this because they do not have to pay as much in taxes. Look at their “Tax Returns” and their recast financials (we are adding back the owner’s salary, interest, depreciation, and we will say that Owner X has a few more add-backs to the business than Owner Z).

You can see that Business X had Ordinary Business Income of $43,600. So along with paying themselves $70,000 + $5,600 in FICA Tax and doing the add-backs in the business they had an SDE of $144,200.

Business Z only had $1,200 in Ordinary Business Income and paid less in personal and employee taxes (FICA) because they paid their employees some cash. Owner Z only pays themselves officially $35,000/year + $2,300 in FICA Taxes). Owner Z probably pockets $81,000 in unreported cash.

If you look at the value of their business, they are light years apart. Business X is worth 2.44 times more than Business Z. Owner Z saved money on paying taxes each year, but business X has less value.

As a broker the best advice I can give to business owners is to keep the cash in your business.

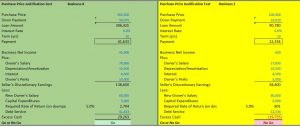

If you look at our “Purchase Price Justification Test” scenarios below, Business X has excess cash after paying the new owner a slightly lower salary to start out, make the loan payment, have money left over for capital expenses (CAPEX) and pay themselves back their down payment on the business. Business Z doesn’t have enough cash flow “on the books” to support a loan from a bank. If they can get someone to believe that they pocket $81,000 in cash every year, the buyer will have to pay 100% cash or the seller may have to finance part of the business to prove how much it really makes.

For argument’s sake, let’s pretend that Owner X paid combined federal and state tax of 15% on personal and business income. So they pay 15% on $113,600 or $17,040.

Owner Z pays the same 15% on their total reported income of $36,200 or $5,430 (they would probably both be in different tax brackets, but for this example I wanted to keep the math manageable). Owner Z saved $11,610 (let’s say over 3 years, he paid a total of $34,830 in federal and state taxes). He lost over $213,000 in value over those 3 years because he didn’t want to pay taxes. There is a very good chance that Owner Z may not be able to sell the business.

My CPA always said “Paying taxes is a sign of a healthy business, one that can be sold someday.”

Owner X paid $51,120 in taxes over those three years. He should be able to sell his business and get a much better payday out of it. As a broker the best advice I can give to business owners is to keep the cash in your business, the short-term pain of paying taxes will be justified by being able to sell your business and selling it for a much higher dollar amount. My past CPA always said “Paying taxes is a sign of a healthy business, one that can be sold someday.”

About Pat McAdams, Wisconsin Business Broker

Business Broker

Murphy Business Sales

Waukesha Wisconsin

I grew up in a family-run business. Growing it into a seven-location operation wasn’t easy. And, neither was the decision to sell it. Most of my 27-year career has been in small business—the last 14 years spent building and then selling a Budget Blinds franchise.

I found my passion, however, helping other entrepreneurs sell their businesses. And, now I’m bringing that passion to Murphy Business.

Why? My experience selling my own business made me realize there were few companies helping small business owners value and prepare their business for sale, find buyers, and close the deal. Even fewer offer fair valuations and unvarnished advice to ensure your valuable time isn’t wasted chasing false expectations.